In recent article we discussed enlargement of the EU and its impact on outsourcing landscape in the region. We considered two phases of expansion as they have been mostly associated with countries representing outsourcing providers market:

In recent article we discussed enlargement of the EU and its impact on outsourcing landscape in the region. We considered two phases of expansion as they have been mostly associated with countries representing outsourcing providers market:- 1st wave in 2004 with Malta, Cyprus, Estonia, Latvia, Lithuania, Poland, Czech Republic, Slovakia, Slovenia, Hungary,

- 2nd wave in 2007 with Bulgaria and Romania

Experts agreed that expansion of the EU boarders further Central and East has contributed to re-arrangements in the state of things in the region’s outsourcing market. Especially the first wave.

Once region’s premier outsourcing destinations, such as Poland, Czech Republic and Hungary which were mainly associated with the growth of nearshore outsourcing in the region have fallen in rank and gave their way as the top locations to Bulgaria and Romania. In 2009 A.T Kearney Global Services Location Index ranked Bulgaria and Romania as top destinations for outsourcing services while Czech Republic, Hungary and Poland fallen significantly.

These re-arrangements were associated with the impact of EU-membership on those 2004 entrants. Economic transformations, wage inflation and increasing operating costs resulted in eliminating cost advantage that countries offered before. While both Romania and Bulgaria representing a second wave of EU enlargement in 2007 being still on the earliest stages of transformation towards EU model. Having improved legislation, market economy and all other qualities needed to meet EU acceptance criteria these countries are developing markets with competitive prices and abundant talent pool.

Further East

However, experts agree that Bulgaria and Romania will not escape the impact of EU membership and some studies already indicated changing environment and growing indicators. Opened borders will attract many talented professionals to search for new opportunities while influx of foreign investment and new standards raise costs.

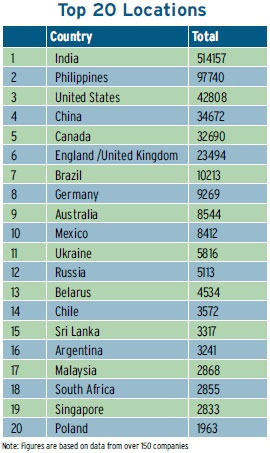

In the meantime we see a growing interest towards far Eastern neighbours, who has not joined the EU yet. According to the 2010 Global Services 100 lists, Ukraine is 11th and Belarus is 13th among Top 20 leading countries in the area of IT Outsourcing and Hi-Tech services with Ukraine representing the region’s biggest IT outsourcing professionals market with 11,000 professionals involved.

With shift in delivery preferences and outsourcing drivers in Europe towards nearshore options experts signal growing interest to Ukraine and Belarus. Being closest of those non-EU member states these counties might represent the second wave of nearshoring trend becoming outsourcing magnets.

No EU expansion till 2020

This trend might be facilitated by the news about the EU expansion plans put on hold till 2020. Instead, the new format for cooperation development with Armenia, Belarus, Georgia, Modlova and Ukraine is planned to be on place, including EU plans to ease visa and trade relations with those non-EU countries in the near future.

Ukraine is announced to get an action plan for visa-free regime with EU member states on November 22, 2010 while Ukraine itself establishment Visa-Free Regime for Citizens of EU since 2005.

Thus, geographical proximity and no-visa traveling together with cost advantages and large resource base will be driving forces for IT outsourcing market growth in Eastern Europe.